Introduction

Automated dialers are reshaping the insurance agency landscape by providing innovative solutions that enhance efficiency and productivity. These advanced systems streamline communication processes, enabling agents to concentrate on what truly matters: connecting with clients and closing sales. As organizations increasingly adopt these technologies, important questions emerge:

- How can automated dialing be effectively integrated into existing operations?

- What specific benefits can agencies anticipate?

This article examines ten compelling ways automated dialers can elevate efficiency for insurance firms, highlighting the potential for significant improvements in performance and client engagement.

Onyx Platform: Streamline Operations with Advanced Dialer Features

The Onyx Platform provides a comprehensive suite of advanced automated dialer features tailored for insurance firms. Its key functionalities - intelligent lead routing, automatic license matching, and DNC integration - enable representatives to connect with clients swiftly while adhering to regulatory standards. Furthermore, real-time dashboards deliver crucial insights into performance, empowering agencies to make informed, data-driven decisions that significantly enhance operational efficiency. By integrating these features seamlessly, Onyx not only streamlines operations but also allows representatives to focus on their primary objective: effectively selling insurance. This method has demonstrated a productivity increase of 30-50% compared to traditional approaches, highlighting the automated dialer's effectiveness in optimizing call center performance.

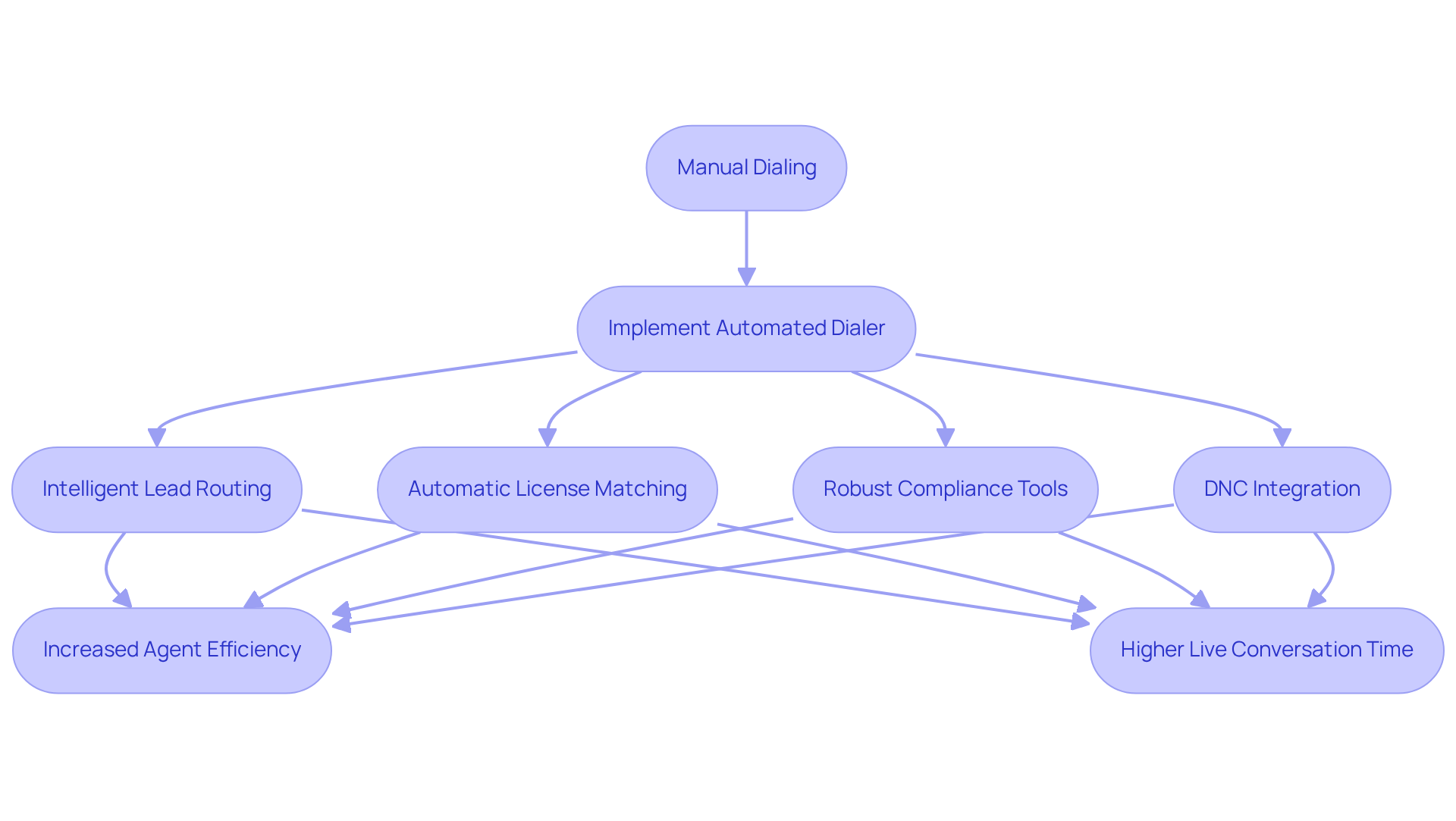

Save Time: Automate Dialing to Increase Agent Efficiency

Automated dialers revolutionize how representatives manage their time, significantly reducing the hours spent on manual tasks. By streamlining the automated dialer process, representatives can focus more on engaging with clients rather than being hindered by repetitive dialing. This shift in focus can lead to a substantial increase in outbound communication productivity, with some reports indicating that an automated dialer can boost representative productivity by as much as 300%. For example, a financial services contact center experienced a 70% increase in live conversation time after implementing an automated dialer software, illustrating how automation can enhance both engagement and efficiency.

The Onyx Platform's advanced automated dialer features are specifically designed to optimize representative productivity, ensuring that they can maximize their time and efforts. With intelligent lead routing, automatic license matching, and robust compliance tools - including seamless call recording and secure storage - agents can connect with prospects more effectively while adhering to regulations. The platform's DNC integration further protects organizations from legal complications, making these technologies essential for insurance firms aiming to thrive in a competitive landscape. As industry expert Niharika Mogili states, "If you’re still manually dialing leads, you’re falling behind." By adopting these technologies, organizations can not only improve their operational efficiency but also enhance their overall sales performance.

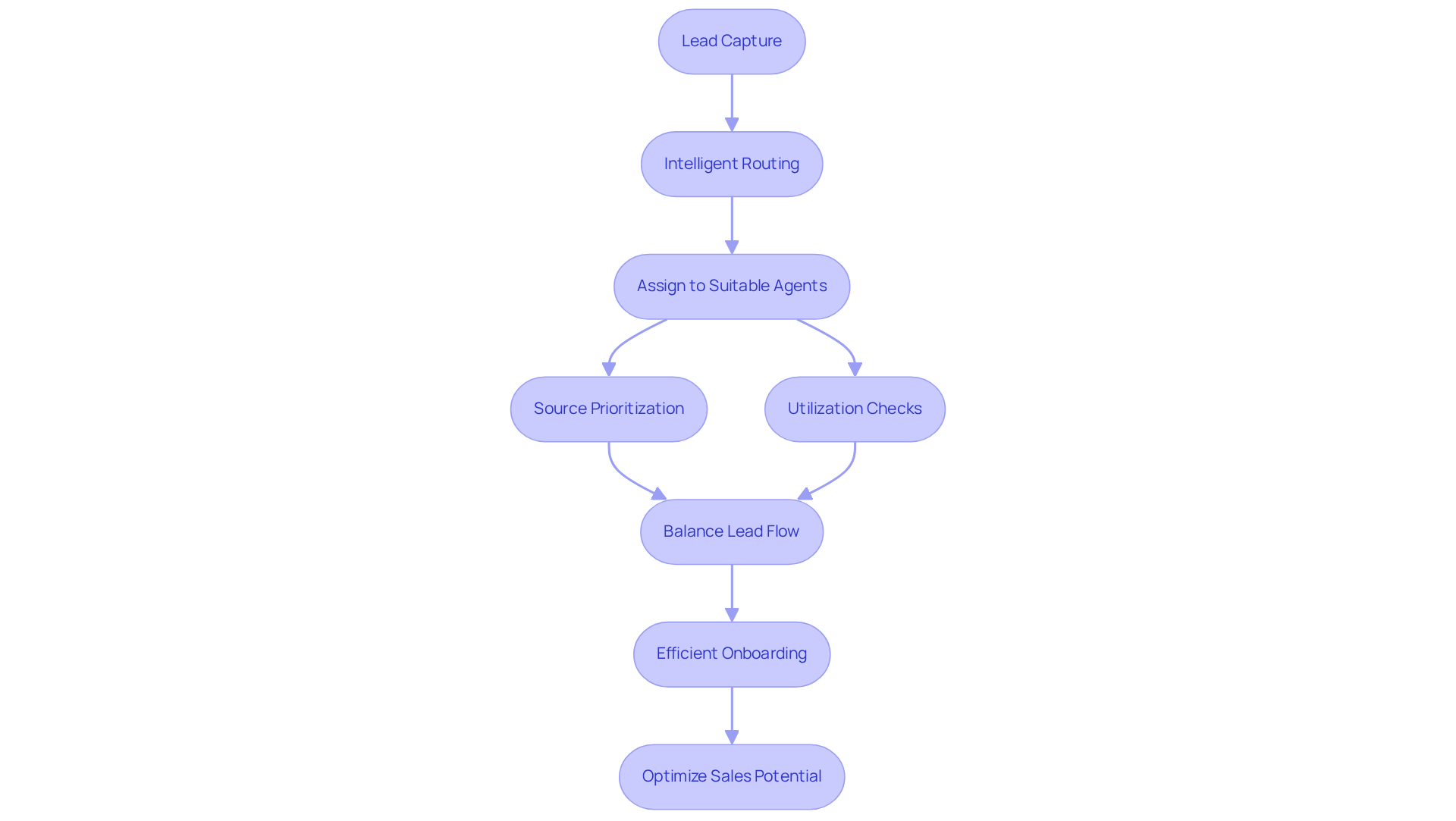

Enhance Lead Management: Intelligent Routing and Distribution

Effective lead management is crucial for insurance agencies that seek to convert prospects into clients. The platform employs intelligent routing to assign leads to the most suitable agents based on their skills and availability. This strategic method not only improves conversion rates but also significantly enhances customer satisfaction. By capturing and distributing leads from any source in real time, Onyx guarantees that no opportunity is overlooked.

Agencies can utilize source prioritization and utilization checks to automatically balance lead flow across their teams, thereby safeguarding the customer experience with intelligent handoffs. Additionally, the onboarding process is crafted to be efficient and seamless, enabling teams to swiftly implement custom settings and receive real-time support.

By optimizing their sales potential through intelligent lead distribution, organizations can concentrate on what truly matters-serving their clients and expanding their business.

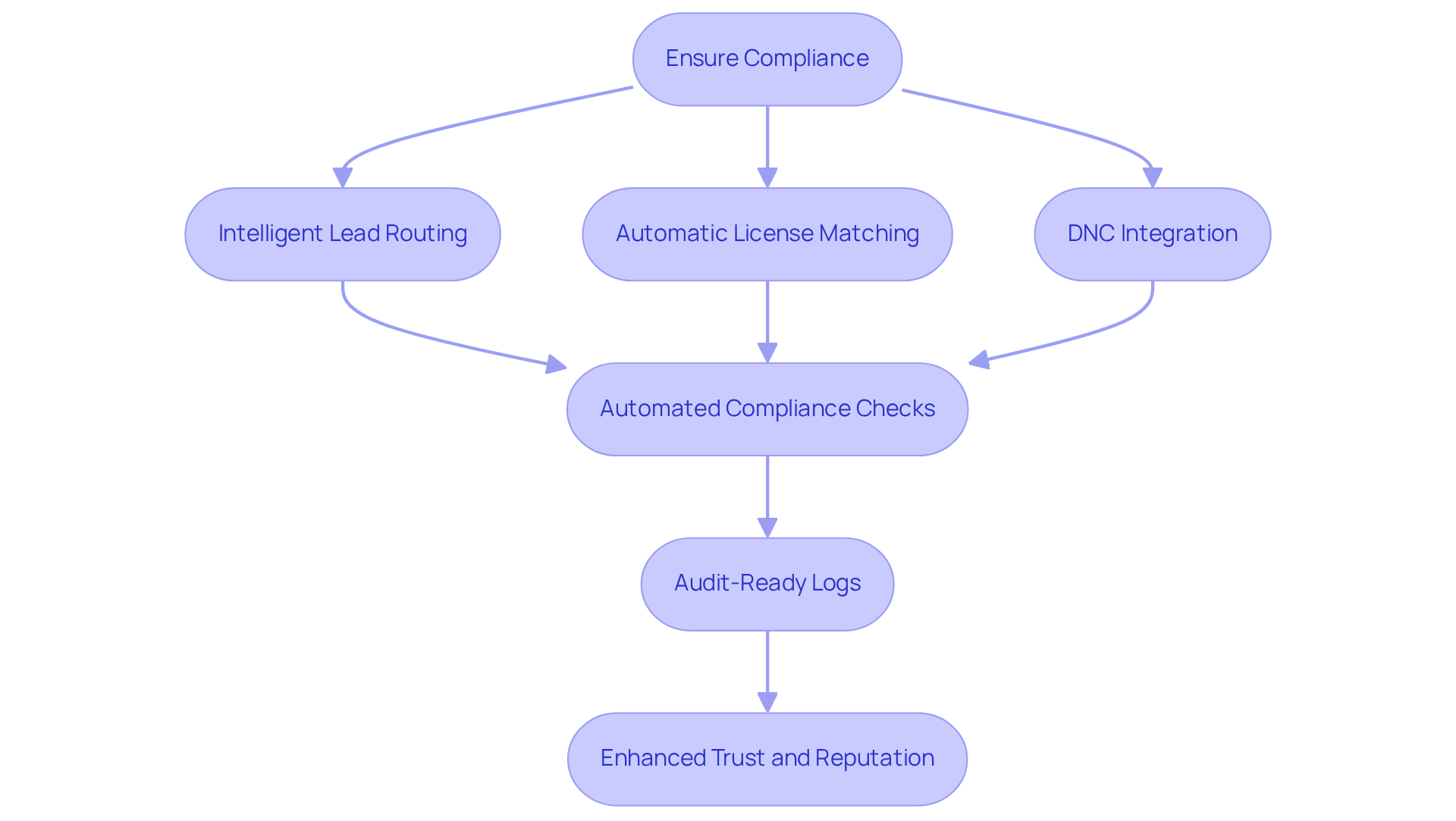

Ensure Compliance: Meet Regulatory Standards with Automated Dialing

Adhering to regulatory standards is essential for insurance firms, particularly regarding the use of an automated dialer. The platform is specifically designed for phone-based sales in regulated sectors and includes advanced compliance features that bolster adherence to complex regulations, such as the Telephone Consumer Protection Act (TCPA). With intelligent lead routing, automatic license matching, and DNC integration, Onyx automates compliance checks and maintains audit-ready logs. This allows organizations to concentrate on their sales efforts without the persistent concern of regulatory violations.

This proactive compliance strategy not only shields the organization from potential penalties, which can range from $500 to $1,500 per violation, but also cultivates trust with clients, thereby enhancing its reputation in a highly regulated industry. Industry experts emphasize that ensuring compliance is not merely a legal obligation; it is a vital component of operational efficiency that can significantly influence an agency's success in navigating the complexities of telemarketing regulations.

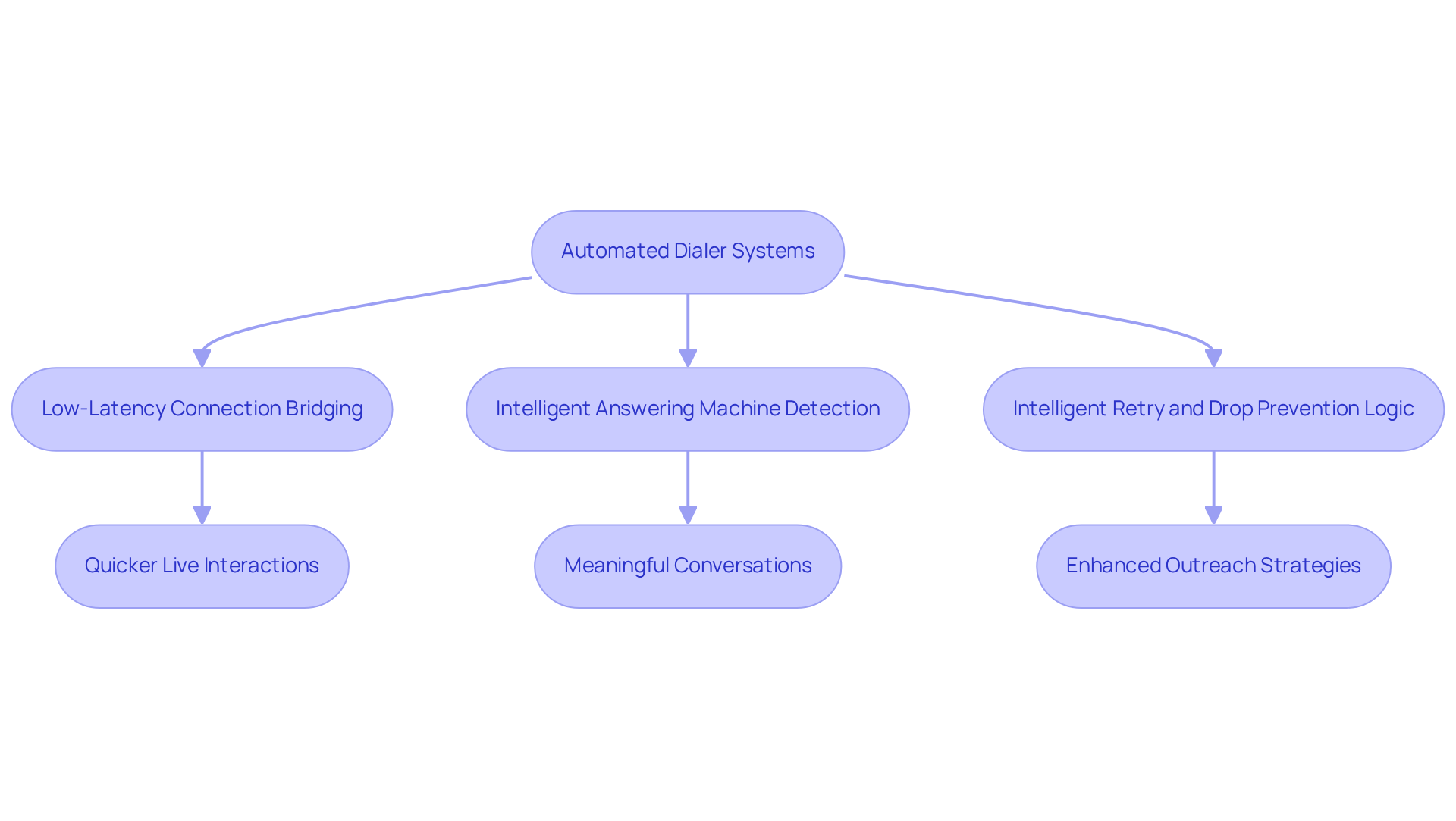

Boost Customer Engagement: Connect with Clients Effectively

Automated dialer systems significantly enhance customer interaction by ensuring that representatives can connect with clients effectively and efficiently. The advanced features of the Onyx Platform, including low-latency connection bridging for quicker live interactions and intelligent answering machine detection with minimal delay, enable agents to reach clients at the right moment. This capability enhances the probability of meaningful conversations.

Furthermore, the platform's intelligent retry and drop prevention logic ensures that requests are managed optimally, which further enhances outreach strategies. By facilitating timely and relevant interactions, organizations can cultivate stronger connections with clients, ultimately resulting in enhanced satisfaction and loyalty.

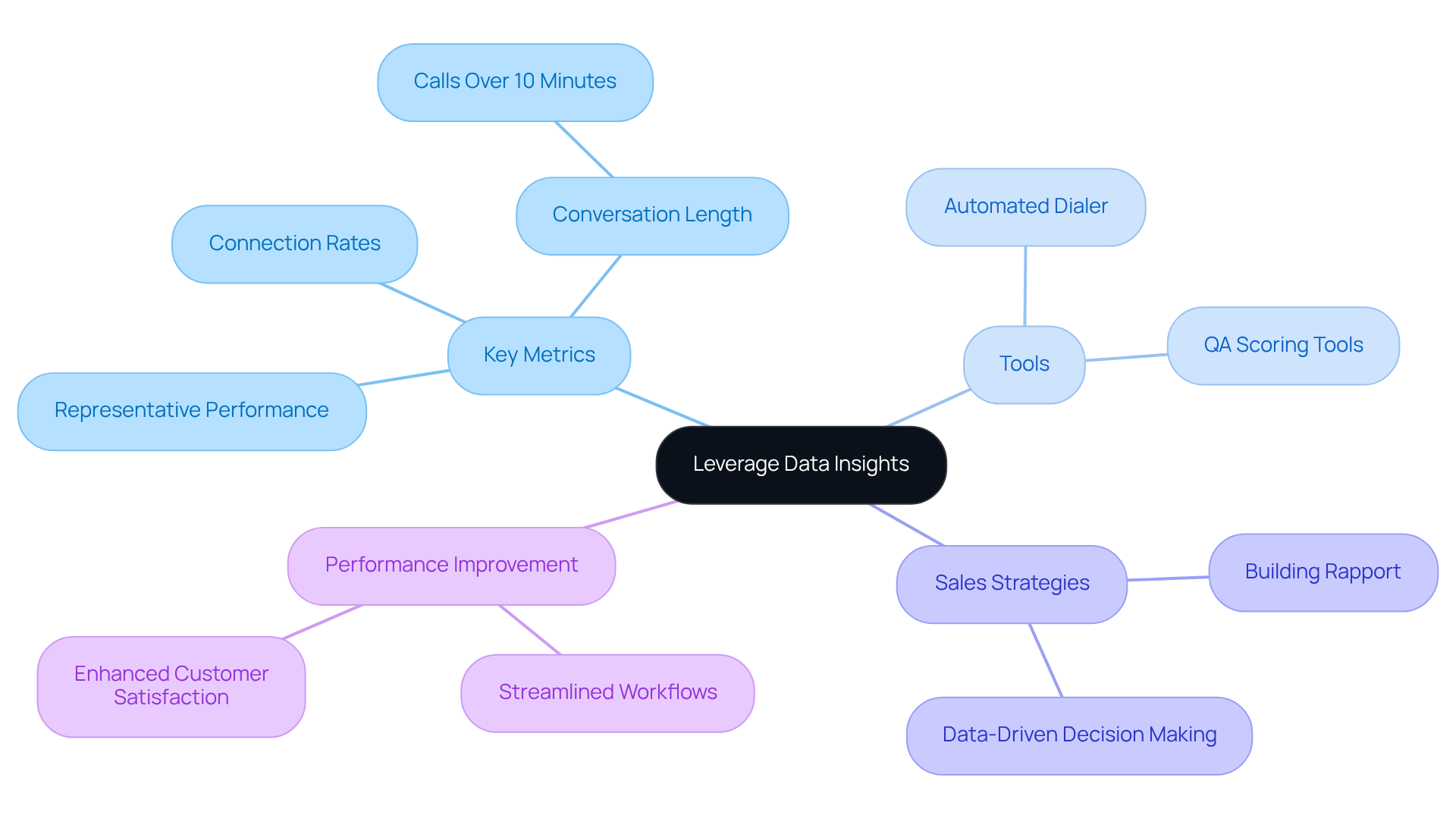

Leverage Data Insights: Transform Call Data into Actionable Strategies

The Onyx Platform empowers insurance firms to harness extensive analytics, transforming communication data into actionable strategies. By meticulously analyzing key metrics such as conversation length, connection rates, and representative performance, organizations can uncover patterns that highlight areas for improvement. For instance, conversations exceeding ten minutes are consistently linked to higher conversion rates, underscoring the importance of building rapport with prospects.

This data-driven approach not only sharpens sales strategies but also streamlines workflows, enhancing overall performance. With features like the automated dialer and QA scoring tools, organizations can ensure compliance with regulatory standards while remaining competitive in a rapidly evolving market.

In an environment where 86% of insurance firms utilize data analytics for core decision-making, leveraging these insights is crucial for sustaining a competitive advantage. Agencies that effectively monitor call quality metrics and adapt their strategies based on real-time data can significantly enhance their sales performance and customer satisfaction. As the insurance sector progresses, integrating advanced analytics into daily operations will be vital for organizations aiming to thrive in a swiftly changing market.

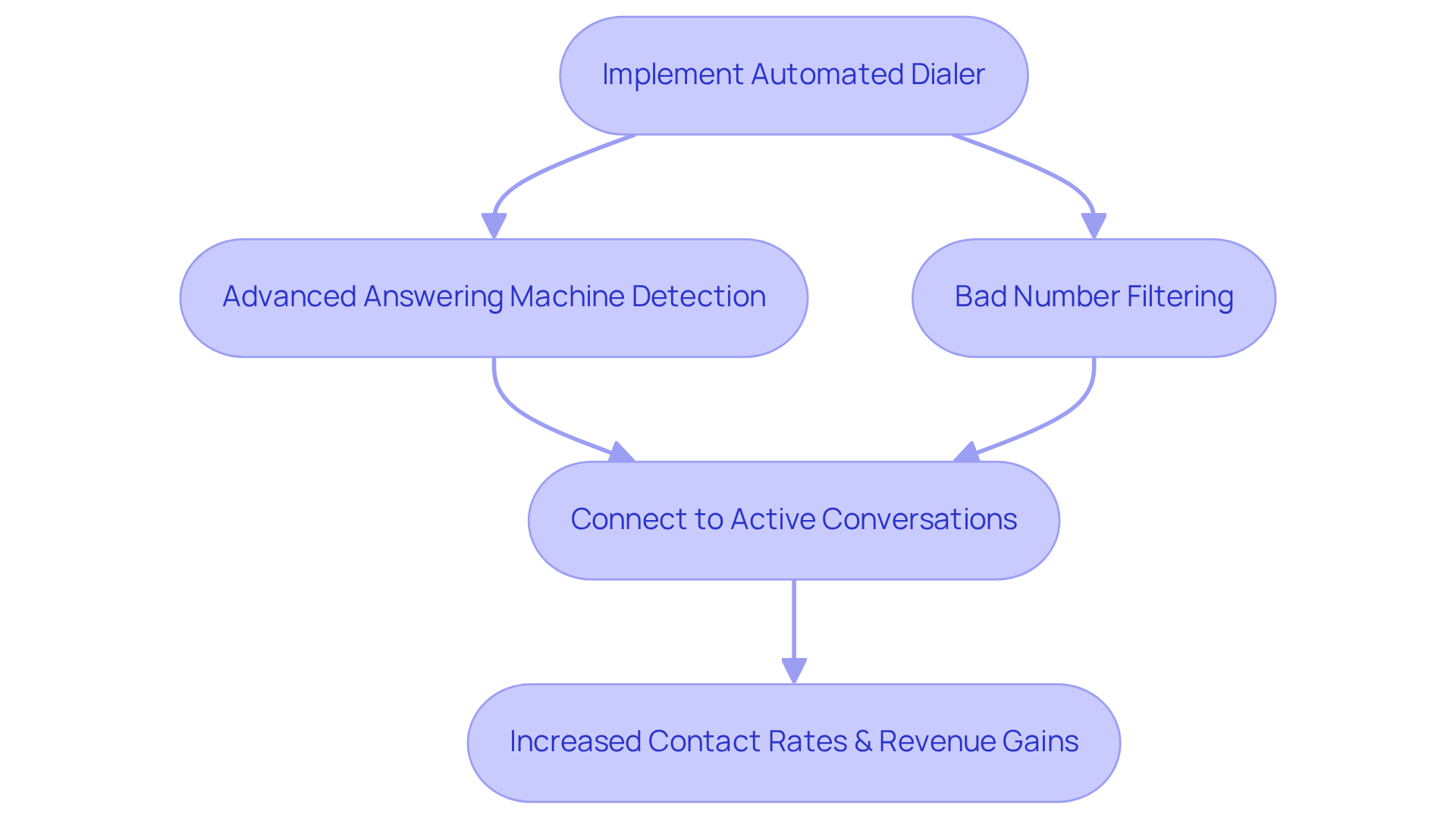

Reduce Missed Connections: Minimize Voicemails and Bad Numbers

Missed connections can significantly impede an insurance firm's ability to engage potential clients. The automated dialer capabilities of the Onyx Platform, especially its advanced answering machine detection (AMD) and effective bad number filtering, are specifically designed to minimize these disruptions. Organizations can greatly reduce the time wasted on voicemails and incorrect numbers by using an automated dialer to ensure that representatives are connected only to active conversations. This streamlined approach not only enhances agent productivity but also increases the likelihood of successful sales outcomes.

In fact, businesses that implement high-quality AMD can experience contact rates rising by up to 80%, leading to substantial revenue gains. Furthermore, with over 85% of missed communications not resulting in a return, improving connection efficiency is essential for maintaining customer engagement and satisfaction. As industry leaders emphasize, fostering live call connections is vital for building trust and ensuring effective communication with clients.

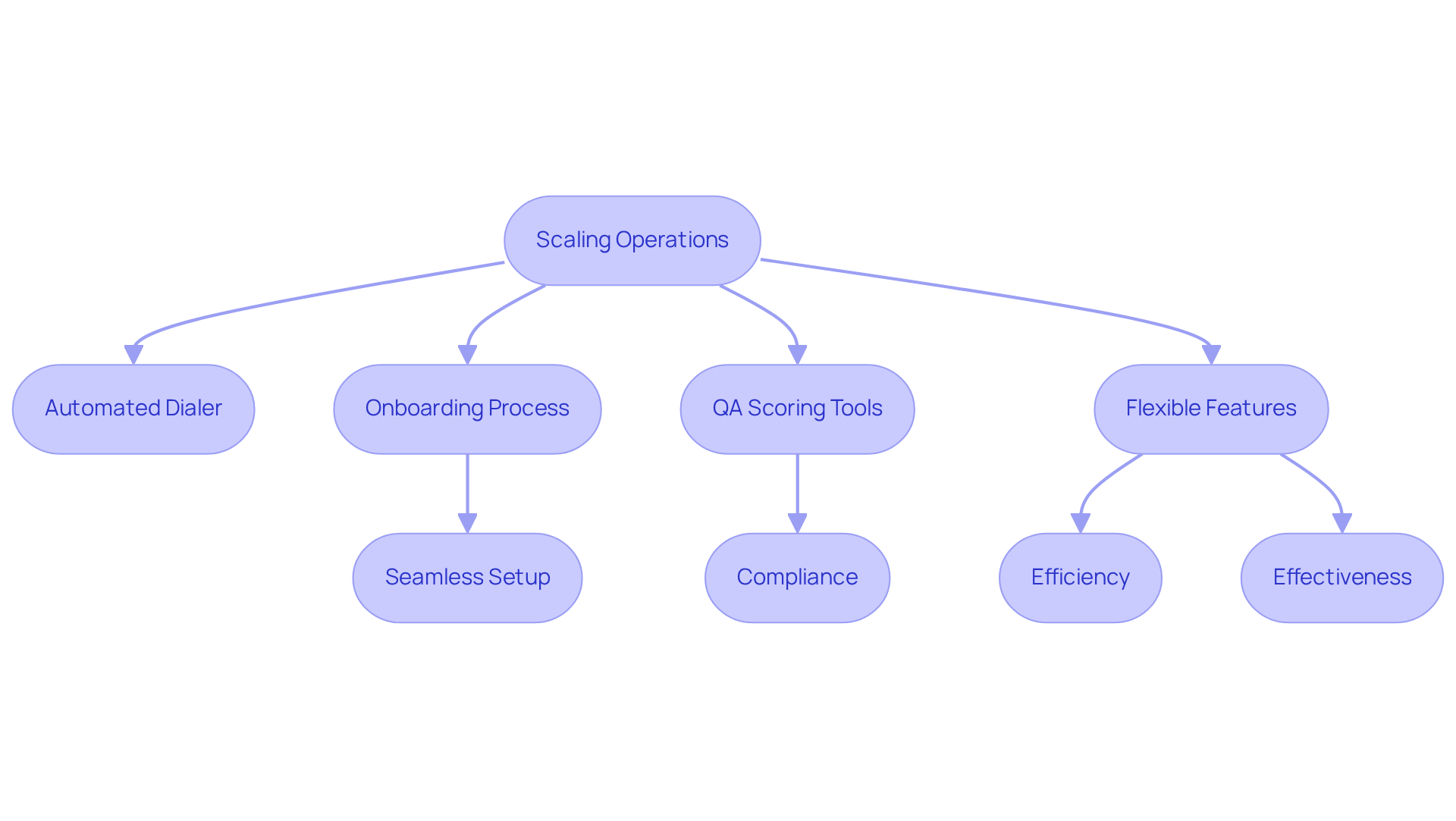

Scale Operations: Adapt Dialing Solutions to Business Growth

As insurance companies expand, their operational requirements evolve. The platform offers scalable dialing solutions, such as an automated dialer, that adapt to these changing business needs. With an efficient onboarding process that ensures a seamless setup, organizations can quickly secure their go-live date and customize their instance to meet specific requirements.

The advanced QA scoring tools allow organizations to assess each interaction with organized, verifiable quality assurance, ensuring compliance and effectiveness in regulated sales. Whether a company is increasing its team size or boosting its call volume, the flexible features - including an automated dialer, DNC integration, and agent coaching tools - ensure that firms maintain both efficiency and effectiveness.

This adaptability empowers agencies to respond to market demands and seize new opportunities without sacrificing service quality. "There is nothing even close to this program in the industry. This is a necessity," states Hyunu Kim from Activate Solutions Group.

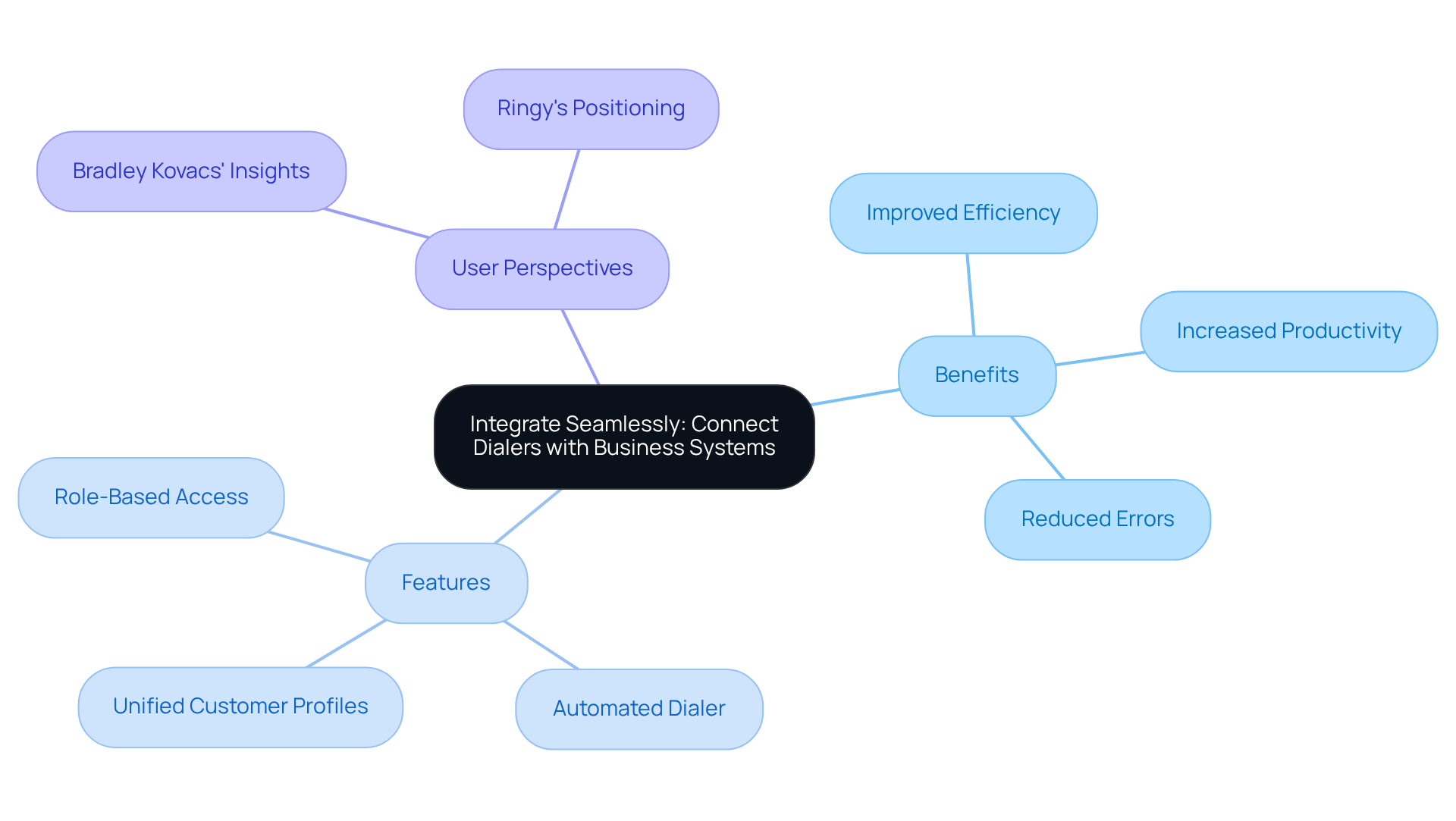

Integrate Seamlessly: Connect Dialers with Existing Business Systems

The Onyx Platform is designed for seamless integration with existing business systems, such as CRM and lead management tools. This connectivity ensures that all client data is synchronized and readily accessible, allowing representatives to operate with enhanced efficiency. With unified customer profiles, representatives can view every policy, interaction, and note in one place, creating a comprehensive timeline of the customer's journey.

By aligning workflows with an automated dialer and incorporating disposition tracking, agencies can significantly improve operational efficiency, reduce data entry errors, and increase overall productivity. The platform's role-based perspectives allow representatives, managers, and administrators to access only the information they need, optimizing workflows without the requirement for complex coding. This approach enables agents to focus on their core responsibilities while fully leveraging their technology stack.

As Bradley Kovacs observes, "Running an insurance agency has never been more demanding," making such integrations crucial for maintaining a competitive edge. Moreover, advancements in business system integration are revolutionizing call center operations, facilitating real-time data synchronization that directly influences productivity and client engagement. Businesses that utilize CRM systems see an average increase of 29% in sales, while AI-driven tools integrated within the platform save sales representatives an average of 4-7 hours each week, underscoring the efficiency gains from this comprehensive solution.

Receive Comprehensive Support: Training and Resources for Effective Use

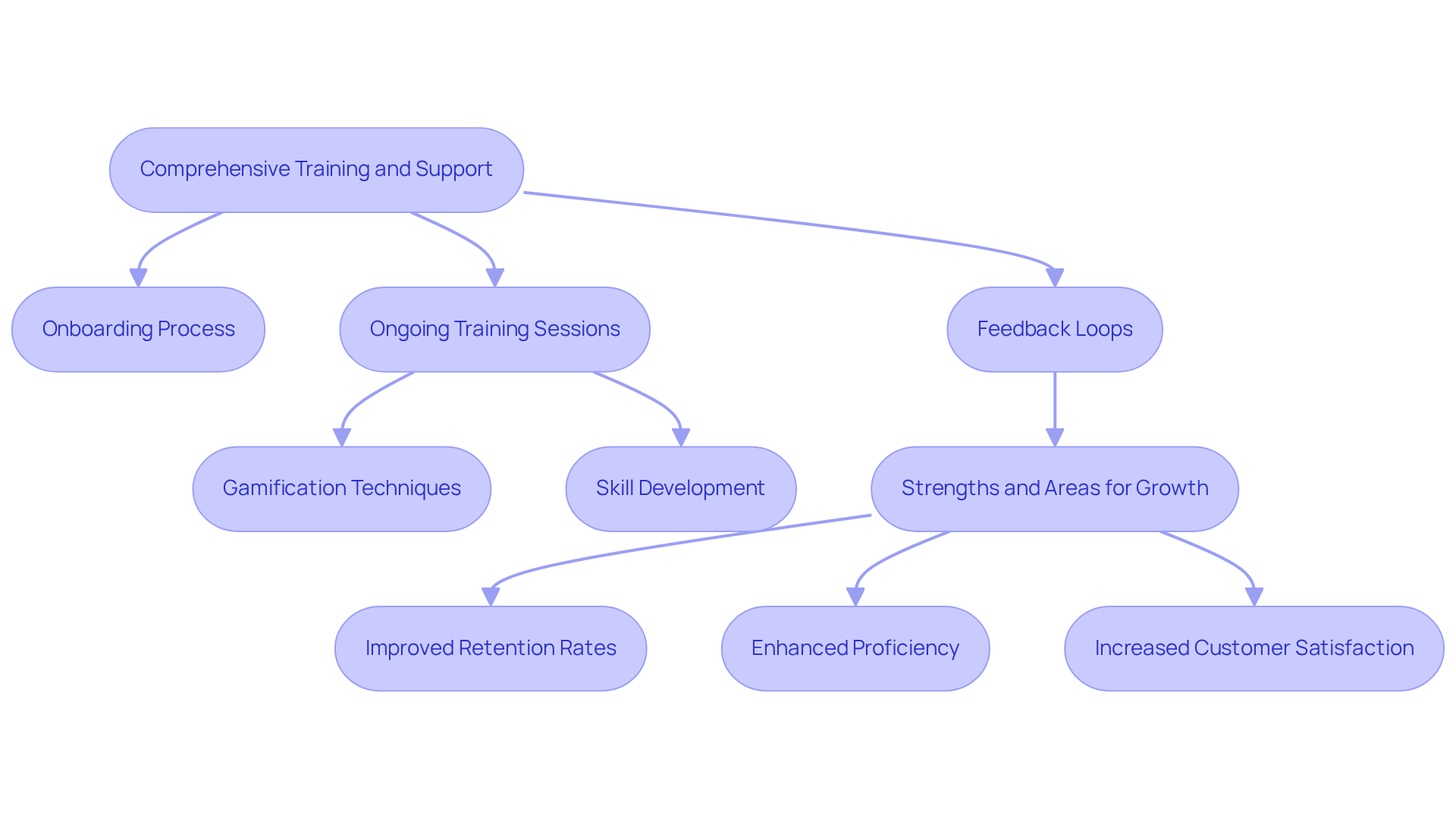

To fully harness the platform's capabilities, comprehensive training and support are crucial. Onyx offers an efficient onboarding process that encompasses guided setup, custom configurations, and ongoing training sessions. This ensures users can effectively leverage features such as unified customer profiles and compliance tracking. Such organized assistance not only enhances representative proficiency but also cultivates a culture of continuous development within the organization.

Research indicates that effective training can improve retention rates by up to 69% over three years, underscoring the significance of investing in skill development. By prioritizing training and establishing feedback loops with specific, timely input on strengths and areas for growth, organizations can optimize their technology investments and achieve superior sales outcomes. This, in turn, leads to increased customer satisfaction and loyalty.

Moreover, incorporating gamification techniques in training can boost engagement and motivation among agents, making the learning process more effective. With Onyx's tailored CRM and compliance features, agencies can streamline their operations and ensure their teams are well-equipped to serve clients efficiently.

Conclusion

Automated dialers serve as a pivotal solution for insurance agencies, significantly enhancing both efficiency and productivity. By utilizing advanced technologies such as the Onyx Platform, agencies can streamline their operations, allowing representatives to engage meaningfully with clients instead of being hindered by manual dialing processes. This transition not only increases productivity but also ensures adherence to regulatory standards, positioning automated dialing as an indispensable tool for contemporary insurance firms.

Key insights throughout the article highlight:

- The substantial time savings achieved through automation

- The critical nature of intelligent lead routing

- The impact of data analytics in refining sales strategies

Features of the Onyx Platform, including DNC integration and real-time performance dashboards, empower agencies to optimize workflows and improve customer interactions. Furthermore, comprehensive training and support are essential for maximizing the advantages of these tools, ensuring representatives are well-equipped to leverage the technology effectively.

Ultimately, adopting automated dialing transcends merely keeping up with industry advancements; it represents an opportunity for growth and enhancement of client relationships. Insurance agencies that invest in these technologies will be better positioned to navigate market complexities, cultivate customer loyalty, and achieve sustainable success. As the industry landscape evolves, the integration of automated systems will be crucial for agencies striving to excel in a competitive environment.

Frequently Asked Questions

What is the Onyx Platform and what are its main features?

The Onyx Platform is designed for insurance firms and offers advanced automated dialer features such as intelligent lead routing, automatic license matching, and DNC integration. These functionalities help representatives connect with clients quickly while complying with regulatory standards.

How does the Onyx Platform enhance operational efficiency for insurance agencies?

The platform provides real-time dashboards that deliver insights into performance, enabling agencies to make informed, data-driven decisions. This helps to significantly enhance operational efficiency, allowing representatives to focus on selling insurance.

What productivity improvements can be expected from using the Onyx Platform's automated dialer?

The automated dialer can lead to a productivity increase of 30-50% compared to traditional methods. Some reports indicate that it can boost representative productivity by as much as 300%, as it allows agents to engage more with clients rather than spending time on manual dialing.

How does the Onyx Platform improve lead management for insurance agencies?

The platform employs intelligent routing to assign leads to the most suitable agents based on their skills and availability, improving conversion rates and customer satisfaction. It captures and distributes leads from any source in real time, ensuring no opportunities are missed.

What compliance features does the Onyx Platform include?

The Onyx Platform includes robust compliance tools such as seamless call recording and secure storage, along with DNC integration to protect organizations from legal complications.

How does the Onyx Platform support the onboarding process for teams?

The onboarding process is designed to be efficient and seamless, allowing teams to implement custom settings quickly and receive real-time support, which helps them optimize their sales potential.

What impact can automated dialers have on outbound communication for representatives?

Automated dialers can significantly reduce the time representatives spend on manual tasks, leading to a substantial increase in outbound communication productivity, as evidenced by a 70% increase in live conversation time in a financial services contact center after implementation.