Introduction

The landscape of insurance sales is evolving rapidly, with technology playing a crucial role in enhancing operational efficiency and customer engagement. Automated dialer software has emerged as a transformative solution for insurance agencies, providing a variety of features aimed at streamlining communication and increasing productivity. This article explores ten leading automated dialer software solutions that can fundamentally change how insurance firms connect with clients, manage leads, and ultimately drive sales. However, with numerous options available, how can agencies identify which solution best meets their specific needs and regulatory requirements?

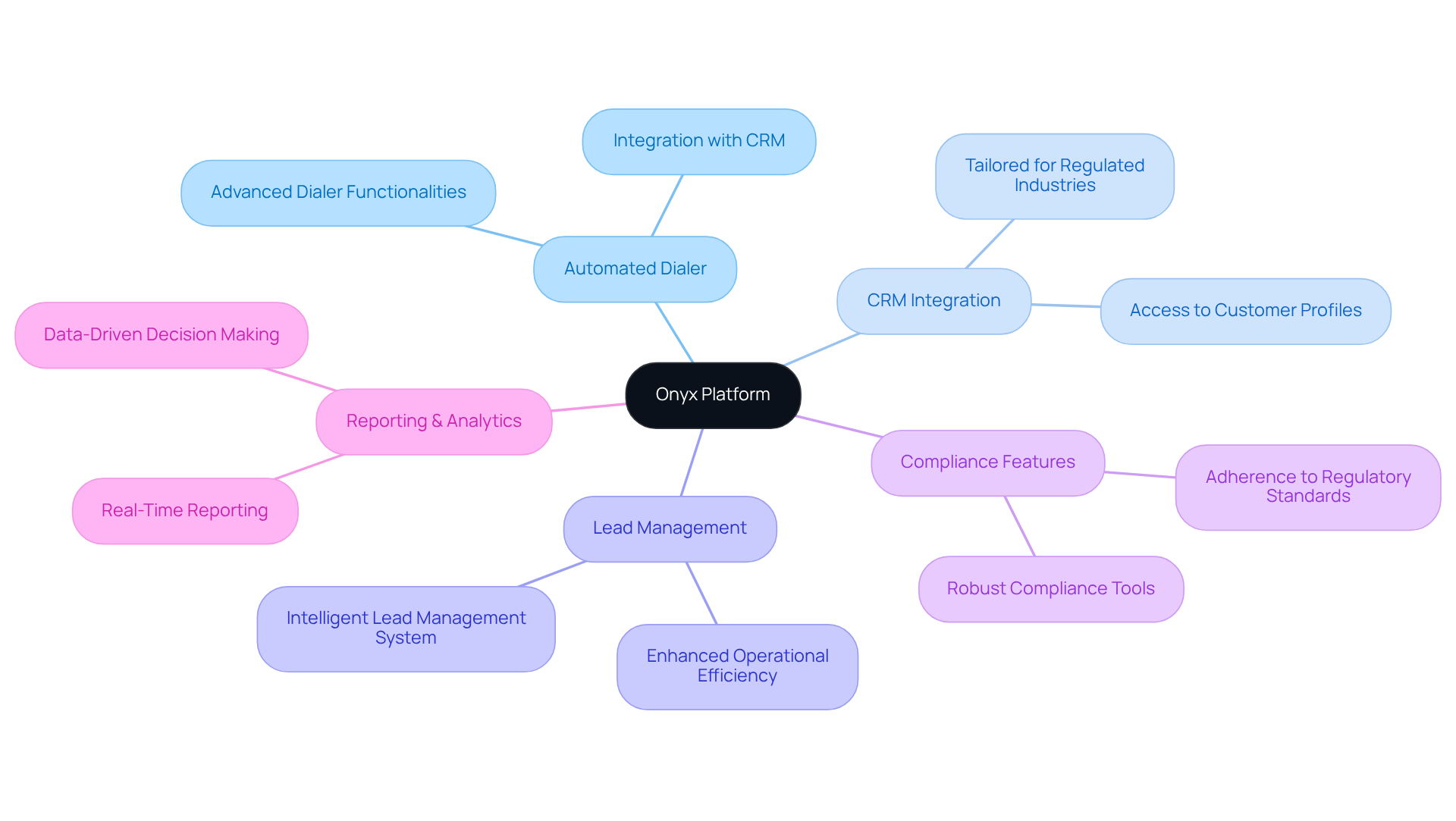

Onyx Platform: Streamline Operations with Advanced Dialer and CRM Integration

The platform distinguishes itself as a comprehensive solution for insurance agencies by integrating automated dialer software with advanced dialer functionalities and a purpose-built CRM. Unlike generic CRMs and automated dialer software that often rely on outdated technology or serve a single purpose, this solution is specifically tailored for phone-based sales in regulated industries. This integration allows for efficient management of customer interactions, giving agents immediate access to essential information, such as customer profiles and policy data.

The platform's intelligent lead management system significantly enhances operational efficiency, while its robust compliance features ensure adherence to regulatory standards. With real-time reporting and analytics, this platform empowers teams to make informed, data-driven decisions, which can lead to improved sales outcomes and overall productivity.

As the CRM landscape evolves, the Onyx Platform illustrates how sophisticated automated dialer software features can transform center operations, making it an indispensable tool for agencies aiming to thrive in a competitive market.

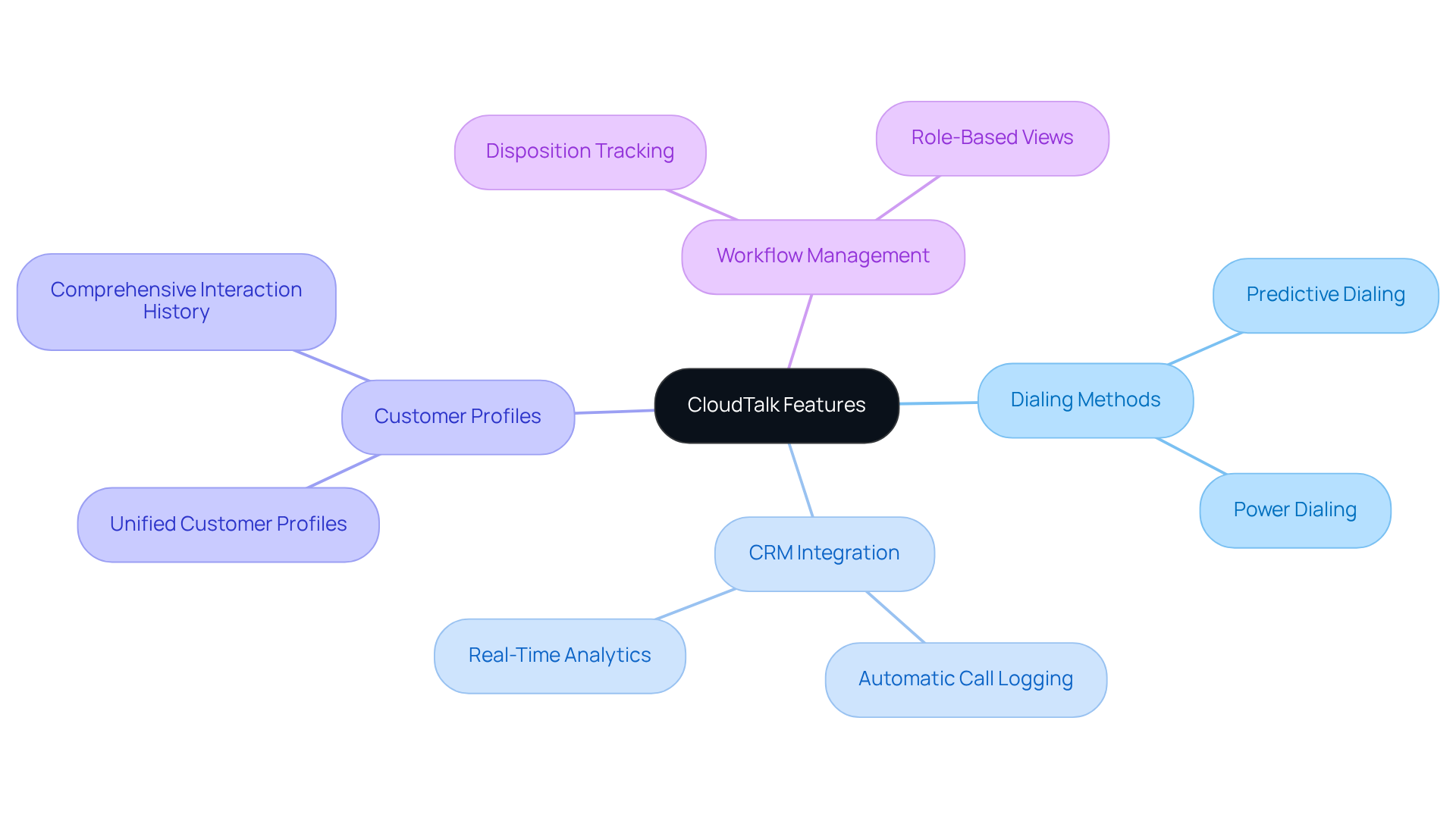

CloudTalk: Boost Call Efficiency with Powerful Auto-Dialer Features

CloudTalk stands out with its robust automated dialer software features, which are specifically designed to enhance communication efficiency. The platform offers various dialing methods, including predictive and power dialing, through automated dialer software, which enable representatives to significantly increase their communication volume. By seamlessly integrating with multiple CRM systems, CloudTalk facilitates automatic call logging and provides real-time analytics. This integration streamlines workflows and allows agents to focus on high-value conversations, ultimately leading to improved sales performance and heightened customer satisfaction.

In addition, the platform provides unified customer profiles that deliver a comprehensive view of each customer's journey, encompassing all policies and interactions. The system also features disposition tracking and role-based views, which empower teams to manage workflows effectively while ensuring compliance. By leveraging both CloudTalk's dialing functions and Onyx's customer management features, insurance firms can enhance their operations and boost overall performance.

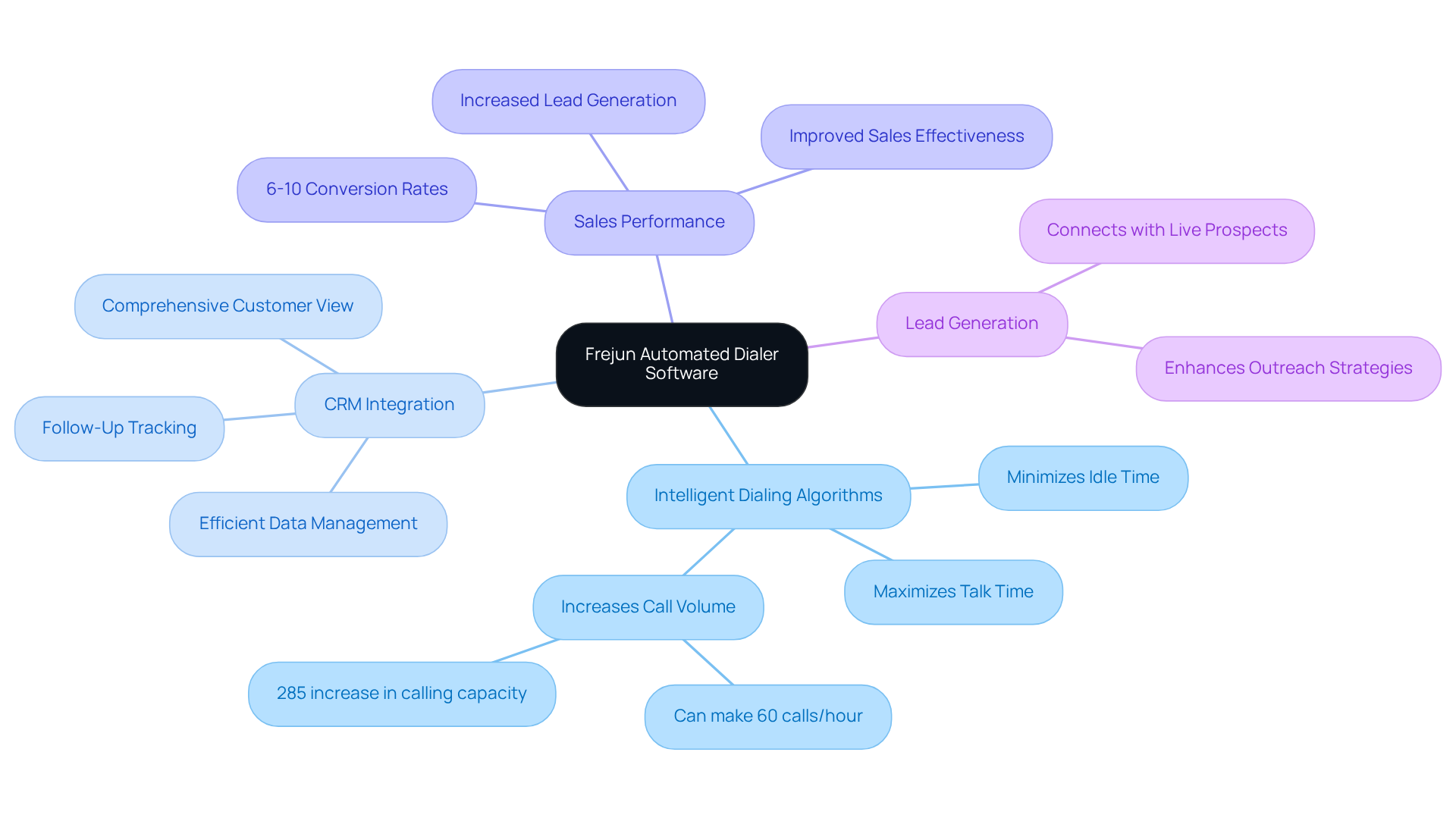

Frejun: Enhance Outbound Call Efficiency with Automated Dialer Software

Frejun provides a powerful automated dialer software that is specifically designed to improve outbound call efficiency for insurance agencies. By utilizing intelligent dialing algorithms, Frejun enables representatives to connect with live prospects more frequently, thereby minimizing idle time and maximizing talk time. This capability is vital, as studies show that top-performing sales teams can achieve conversion rates of 6-10% when employing advanced dialing technologies.

The platform integrates seamlessly with CRM systems, promoting efficient data management and follow-up tracking. This integration allows representatives to maintain a comprehensive view of customer interactions, which is essential for nurturing leads and closing sales. With its intuitive interface and robust analytics, Frejun empowers agents to refine their calling strategies, ultimately leading to improved sales performance. Organizations using Frejun have reported significant increases in lead generation and overall sales effectiveness, highlighting the impactful role of automated dialer software in the insurance sector.

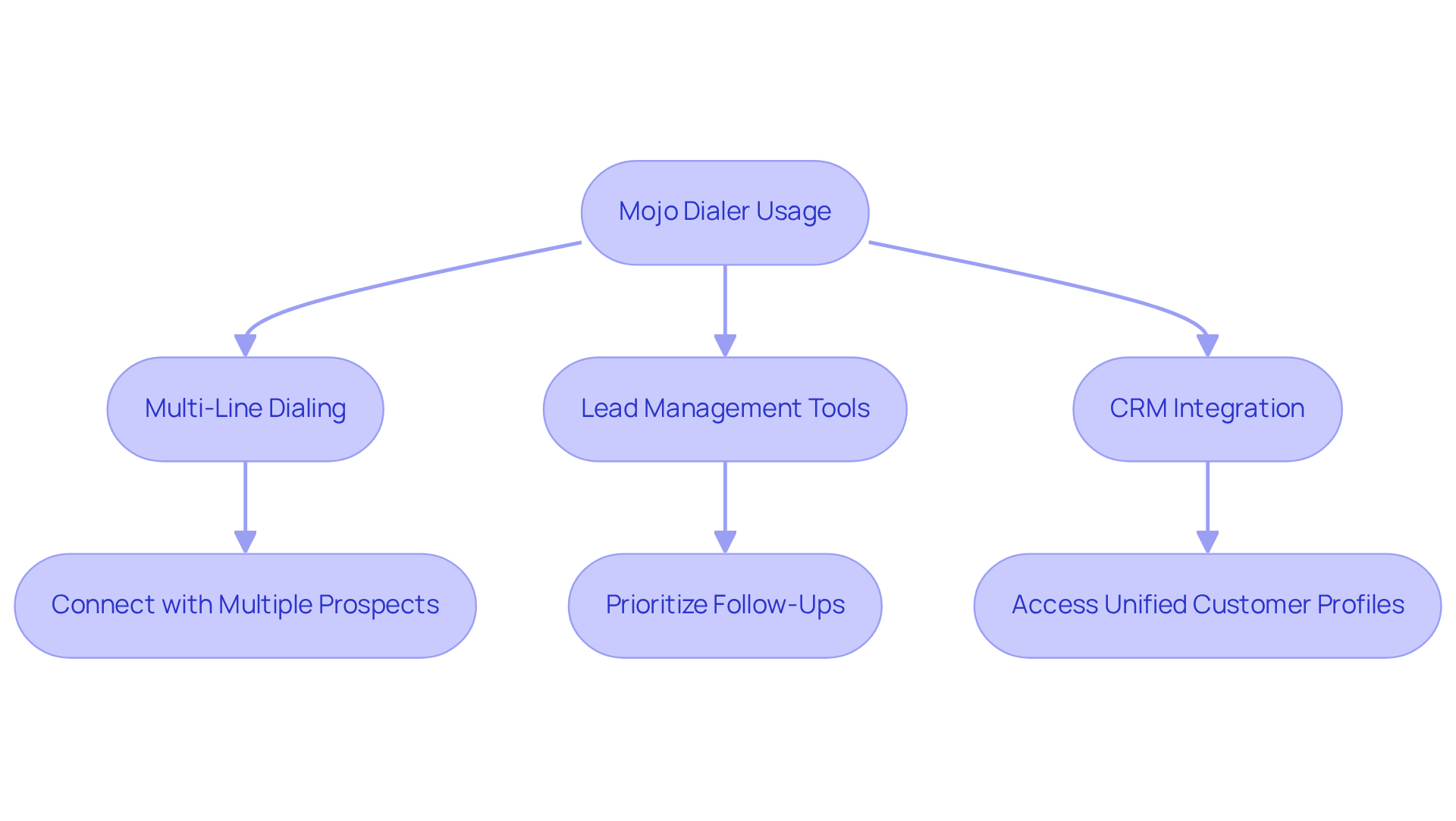

Mojo Dialer: Maximize Conversations and Streamline Lead Generation

Mojo Dialer, an automated dialer software, is designed to enhance conversations and optimize lead generation for insurance agencies. By employing multi-line dialing, representatives can connect with multiple prospects simultaneously, significantly improving their outreach effectiveness. This capability, combined with integrated CRM features, allows representatives to manage their interactions seamlessly, enabling them to engage with more leads in less time.

The platform's lead management tools are vital for prioritizing follow-ups and tracking interactions, which are essential for maximizing conversion rates. Research shows that effective lead management can boost sales conversion rates by as much as 40%, highlighting the necessity of timely and organized follow-up strategies. By automating repetitive tasks with automated dialer software, Mojo Dialer empowers representatives to concentrate on building relationships and closing sales, ultimately driving revenue growth.

Furthermore, user testimonials underscore the effectiveness of multi-line dialing in enhancing productivity. Agents report that utilizing this feature has resulted in a notable increase in their daily outreach, leading to more opportunities for closing deals. In a competitive landscape, Mojo Dialer, as an automated dialer software, stands out as an indispensable tool for insurance firms aiming to enhance their sales performance and streamline their lead generation processes.

To further improve outreach strategies, integrating the platform's streamlined CRM features can provide insurance firms with unified customer profiles, ensuring that every policy, interaction, and note is accessible in one location. This not only enhances compliance but also facilitates better tracking of customer journeys, making follow-ups more effective. With Onyx's role-based views and audit trails, agents can uphold a high level of organization and compliance, further advancing their success in lead management and conversion.

G2: Compare Auto-Dialer Options for Informed Decision-Making

G2 serves as a crucial resource for insurance firms looking to assess various automated dialer software options. It offers comprehensive user reviews, detailed feature comparisons, and transparent pricing information, empowering organizations to make informed decisions that align with their operational requirements. This analytical approach is essential for pinpointing the most appropriate automated dialer software to enhance sales processes while complying with industry regulations.

Industry leaders emphasize the importance of leveraging user feedback in software selection, allowing organizations to opt for solutions that not only boost productivity but also integrate seamlessly into their existing workflows.

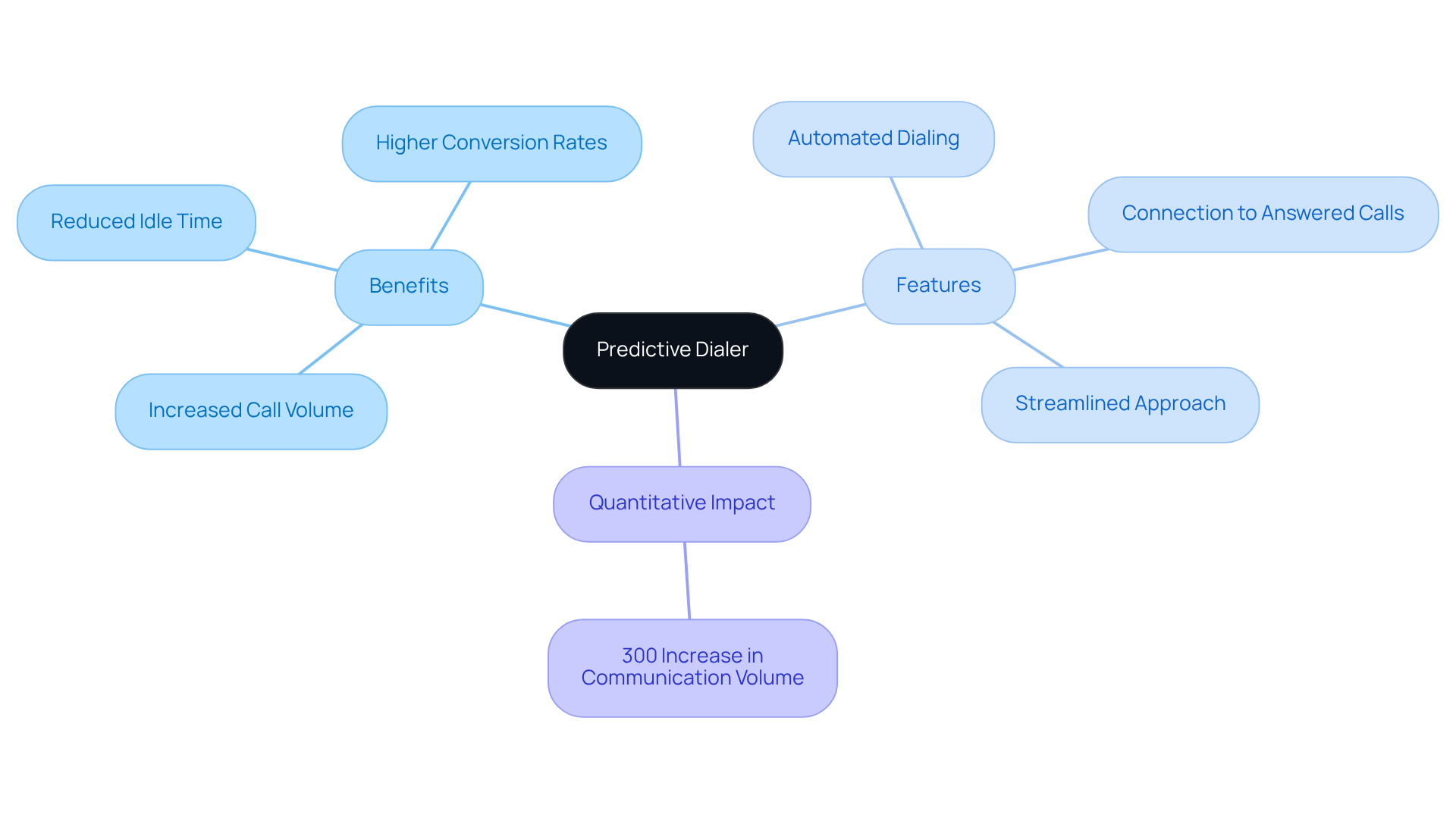

Predictive Dialer: Increase Call Volume and Agent Productivity

Predictive dialers, such as automated dialer software, serve as innovative tools that can greatly enhance communication volume and representative productivity within insurance firms. By using automated dialer software to automate the dialing process and connect representatives solely to answered calls, predictive dialers effectively reduce idle time. This allows representatives to concentrate on engaging with prospects. Such a streamlined approach not only maximizes talk time but also contributes to higher conversion rates, as agents can reach more potential clients in a shorter period.

For instance, organizations that utilize predictive dialing have reported increases in daily communication volume by as much as 300%. This surge in activity translates into improved sales performance and operational efficiency. As a result, automated dialer software has become an essential component of contemporary sales strategies, empowering insurance firms to enhance their outreach efforts and achieve better outcomes.

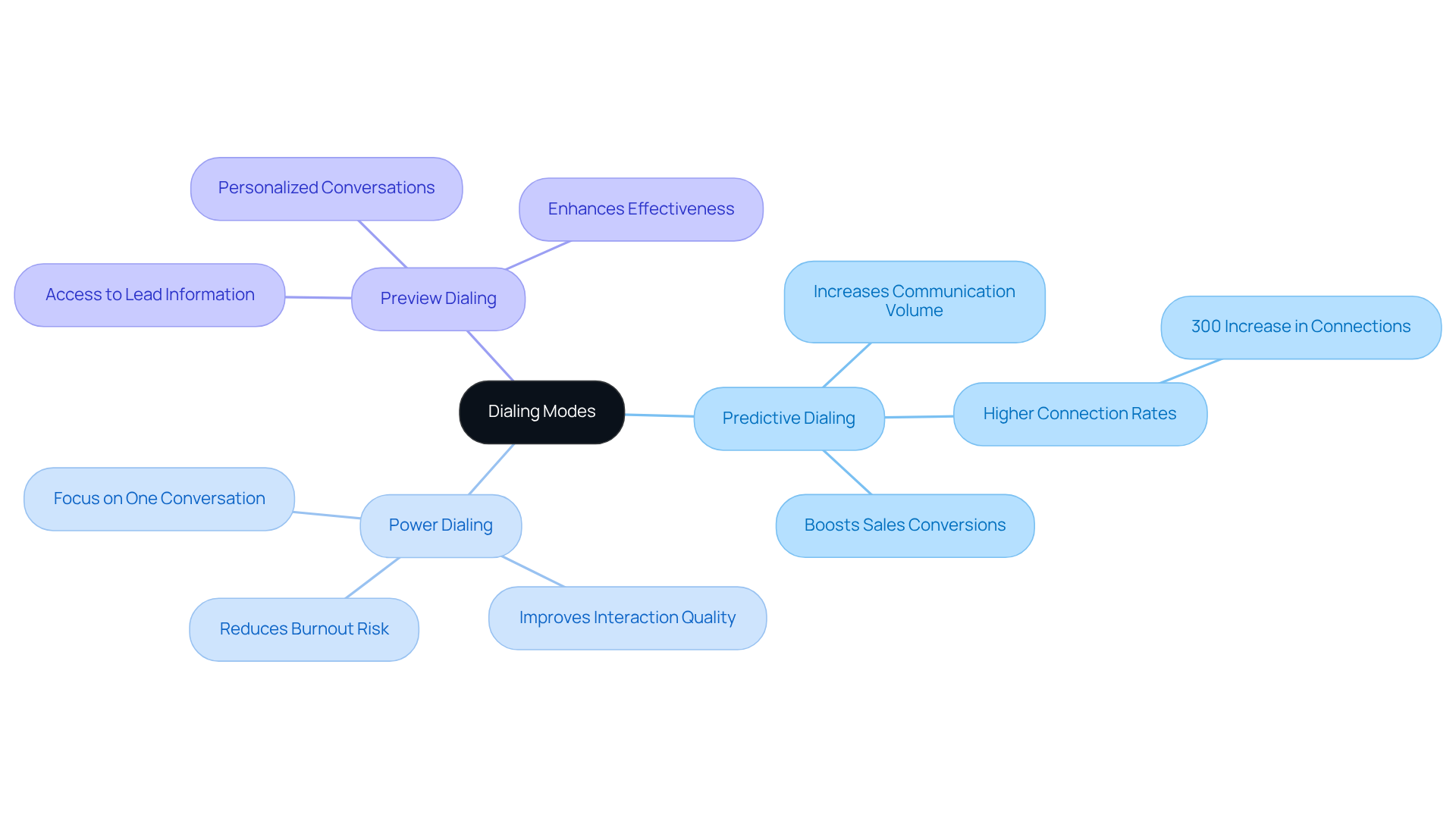

Dialing Modes: Connect Calls More Effectively for Better Outcomes

Dialing methods, particularly automated dialer software, play a crucial role in enhancing communication links and achieving better outcomes in insurance firms. The three primary modes - predictive, power, and preview dialing - each present unique advantages.

- The use of automated dialer software for predictive dialing increases communication volume by simultaneously dialing multiple numbers, which significantly boosts the chances of connecting with potential clients. For instance, agencies utilizing predictive dialing have reported up to a 300% increase in connections, leading to higher sales conversions.

- Conversely, power dialing allows representatives to concentrate on one conversation at a time, improving the quality of interactions and reducing the risk of burnout.

- Preview dialing equips representatives with essential lead information prior to making a call, fostering more personalized and effective conversations.

The Platform enhances these dialing methods through integrated customer profiles, enabling representatives to access every policy, interaction, and note in one centralized location. This feature ensures that representatives have all necessary information readily available, resulting in more informed and effective conversations.

Furthermore, Onyx's dynamic scripting engine facilitates customizable call scripts, streamlining agent workflows and ensuring compliance with industry regulations. For example, an insurance firm that transitioned from power to predictive dialing saw a 40% increase in conversion rates within just a few months. By leveraging these advanced features, insurance firms can utilize automated dialer software to optimize their dialing strategies and significantly enhance their performance.

Cost Optimization: Improve ROI with Auto-Dialer Software

Cost optimization is essential for insurance firms looking to improve ROI through auto-dialer software. Automating dialing procedures allows organizations to reduce labor costs and increase the number of contacts made each hour. This efficiency leads to higher sales volumes without the necessity for additional staffing.

Furthermore, many auto-dialer solutions, such as the Platform, offer tiered pricing structures, allowing organizations to select a plan that aligns with their budget and operational needs. For example, the company provides options that cater to various organization sizes and call volumes, ensuring that every firm can find a suitable plan.

Onyx also guarantees a smooth onboarding experience, equipping teams with training and establishing real-time support channels, which further boosts operational efficiency.

As Hyunu Kim from Activate Solutions Group remarks, "There is nothing even close to this program in the industry. This is a necessity."

By thoroughly evaluating costs and benefits, organizations can optimize their investment in auto-dialer technology.

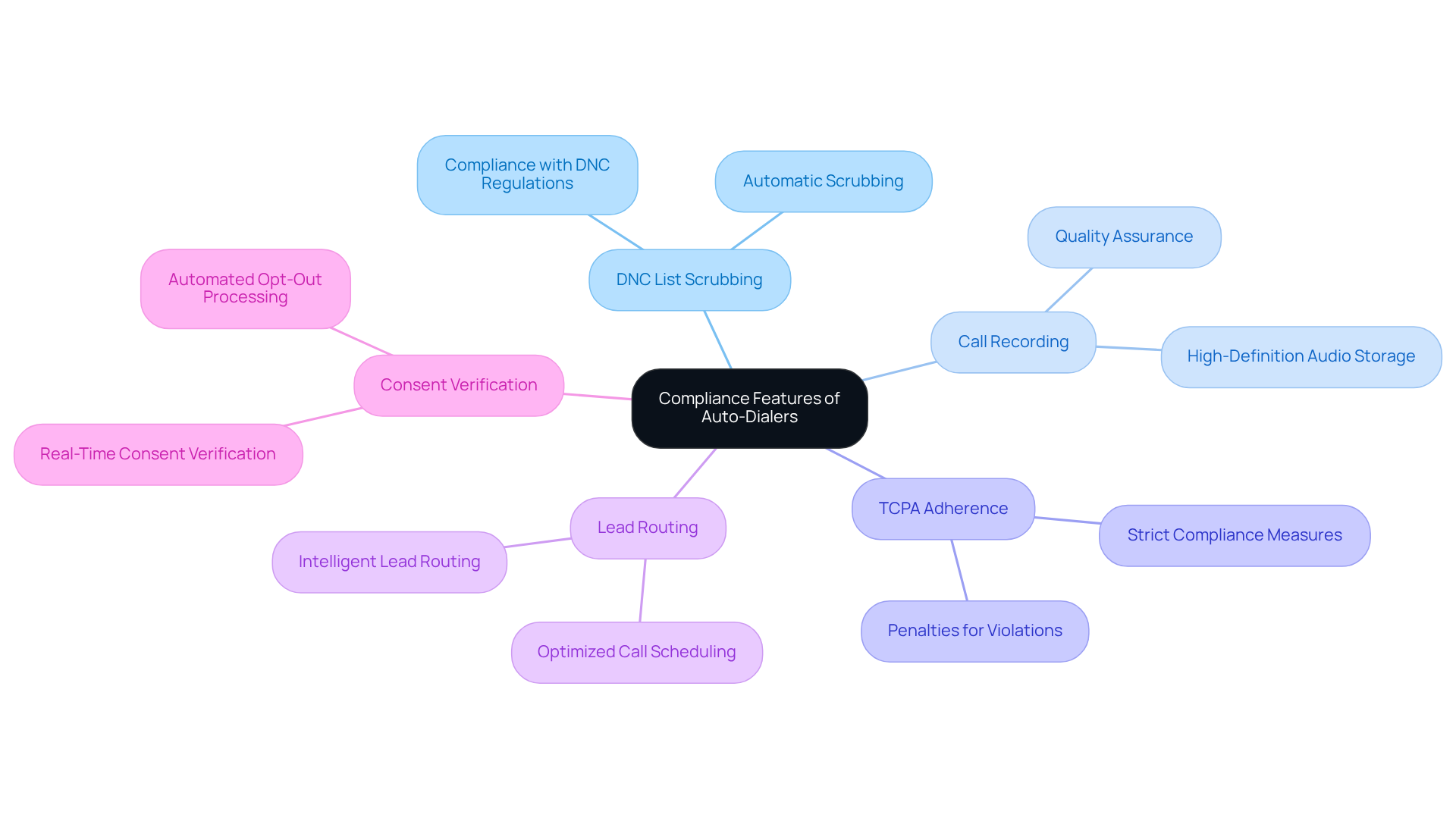

Compliance Features: Ensure Regulatory Adherence with Auto-Dialers

Compliance features are essential in auto-dialer software for insurance firms, especially given the stringent regulations that govern telemarketing and customer interactions. Agencies must prioritize dialers that come with built-in compliance tools to effectively navigate these complexities. This platform distinguishes itself by offering:

- Automatic Do Not Call (DNC) list scrubbing

- Call recording capabilities for quality assurance

- Strict adherence to the Telephone Consumer Protection Act (TCPA)

These features are crucial in preventing penalties that can range from $500 to $1,500 for each violation.

In addition to these compliance features, the platform provides:

- Intelligent lead routing

- Seamless integration with quoting tools, enrollment platforms, and marketing systems

This ensures that organizations can manage their workflows efficiently. Furthermore, the platform supports:

- Real-time consent verification

- Automated opt-out processing

These are vital for maintaining regulatory standards.

As the telemarketing landscape continues to evolve, the significance of compliance remains paramount. With TCPA class action filings on the rise, organizations must implement proactive compliance measures to protect their operations. By leveraging advanced auto-dialer features, insurance firms can ensure their dialing practices align with legal standards, thereby reducing risks and preserving their reputation in a highly regulated industry.

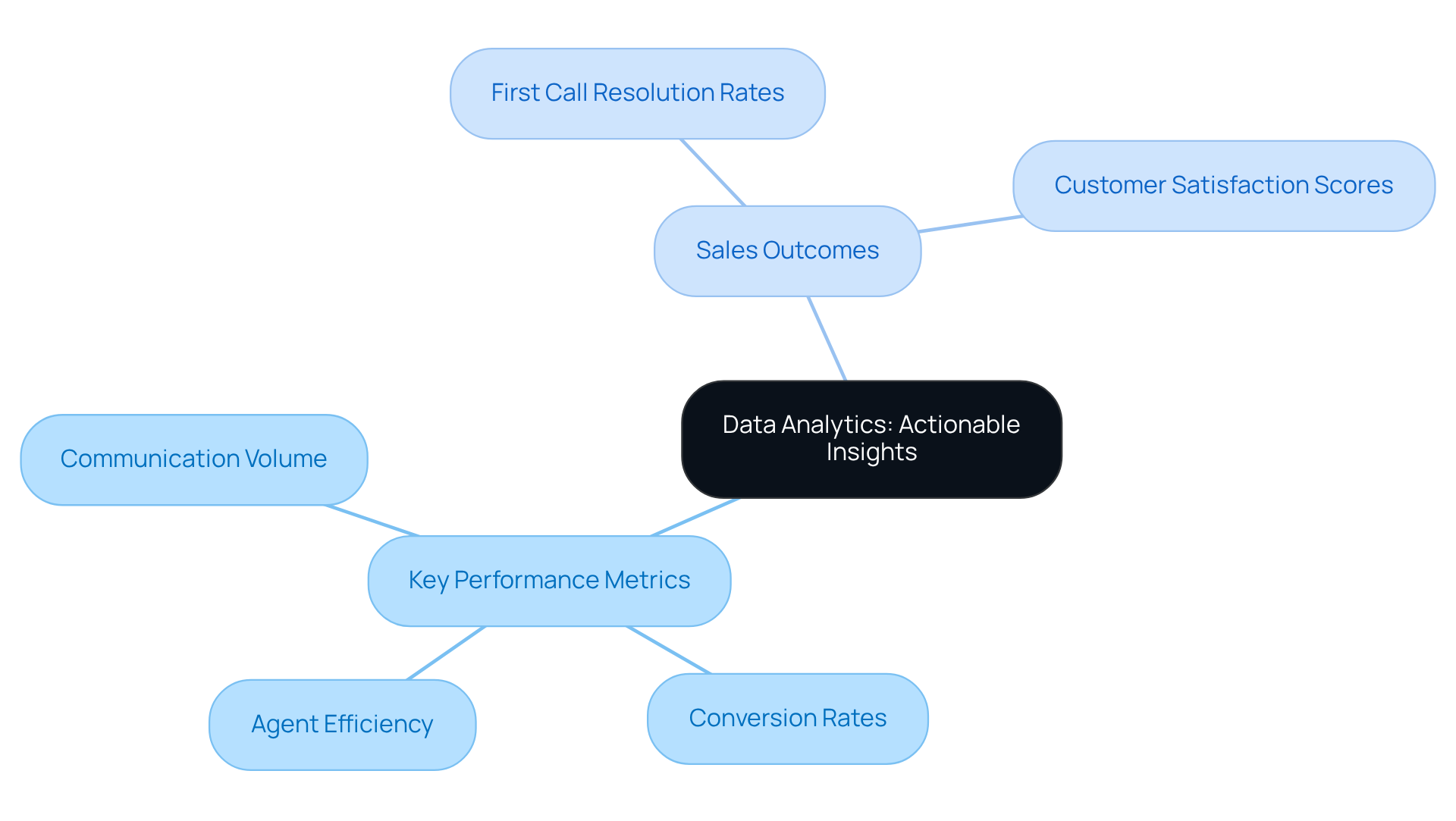

Data Analytics: Turn Call Data into Actionable Insights

Data analytics plays a vital role in transforming communication data into actionable insights that drive sales growth in insurance firms. By utilizing analytics tools integrated within the platform's automated dialer software, organizations can monitor key performance metrics such as:

- Communication volume

- Conversion rates

- Agent efficiency

Onyx's sophisticated QA scoring tools facilitate structured evaluations of each call, ensuring compliance and performance in regulated sales environments. This data empowers organizations to identify trends, refine their calling strategies, and make informed, data-driven decisions that improve sales outcomes.

Furthermore, real-time analytics enable organizations to swiftly adjust their tactics, ensuring agility and responsiveness to changing market dynamics. For example, agencies that effectively utilize Onyx's analytics and QA features have reported notable enhancements in:

- First call resolution rates

- Customer satisfaction scores

This highlights the significant impact of data on their operations.

Conclusion

The integration of automated dialer software into insurance agencies represents a significant advancement that enhances operational efficiency and boosts sales performance. By utilizing advanced features and tailored functionalities, agencies can streamline their communication processes, allowing representatives to focus more on engaging with potential clients rather than managing tedious dialing tasks.

This article has highlighted several leading automated dialer solutions, including the Onyx Platform, CloudTalk, Frejun, and Mojo Dialer. Each of these platforms offers unique features that cater specifically to the needs of insurance firms. Key aspects such as intelligent lead management, compliance tools, and data analytics capabilities demonstrate how these systems can significantly improve conversion rates, customer satisfaction, and overall productivity.

In a competitive market, selecting the right automated dialer software can make a substantial difference. Organizations must prioritize solutions that enhance efficiency while ensuring regulatory compliance and facilitating data-driven decision-making. By investing in the appropriate technology, insurance agencies can position themselves for success, driving growth and maintaining a competitive edge in the industry. Embracing these tools is essential for any agency aiming to thrive in today's dynamic landscape.

Frequently Asked Questions

What is the Onyx Platform and what makes it unique for insurance agencies?

The Onyx Platform is a comprehensive solution that integrates automated dialer software with advanced dialer functionalities and a purpose-built CRM specifically tailored for phone-based sales in regulated industries. It stands out by providing efficient management of customer interactions and immediate access to essential information.

How does the Onyx Platform enhance operational efficiency?

The platform features an intelligent lead management system that significantly enhances operational efficiency and includes robust compliance features to ensure adherence to regulatory standards.

What kind of reporting and analytics does the Onyx Platform offer?

The Onyx Platform provides real-time reporting and analytics, empowering teams to make informed, data-driven decisions that can lead to improved sales outcomes and overall productivity.

What are the key features of CloudTalk's automated dialer software?

CloudTalk offers various dialing methods, including predictive and power dialing, which enhance communication efficiency. It also integrates with multiple CRM systems for automatic call logging and provides real-time analytics.

How does CloudTalk improve sales performance and customer satisfaction?

By streamlining workflows and allowing agents to focus on high-value conversations, CloudTalk ultimately leads to improved sales performance and heightened customer satisfaction.

What functionalities does CloudTalk provide for managing customer interactions?

CloudTalk provides unified customer profiles that deliver a comprehensive view of each customer's journey, along with disposition tracking and role-based views to empower teams in managing workflows effectively.

What is Frejun and how does it enhance outbound call efficiency?

Frejun is an automated dialer software designed to improve outbound call efficiency for insurance agencies by utilizing intelligent dialing algorithms that connect representatives with live prospects more frequently.

What benefits do organizations experience when using Frejun?

Organizations using Frejun report significant increases in lead generation and overall sales effectiveness, as the platform allows for efficient data management and follow-up tracking.

How does Frejun integrate with CRM systems?

Frejun integrates seamlessly with CRM systems, promoting efficient data management and allowing representatives to maintain a comprehensive view of customer interactions, which is essential for nurturing leads and closing sales.